Brink's Payback Points℠

Get paid up to 2 days faster3

Enroll in Direct Deposit to get yout paycheck or government benefits in your Card Account up to 2 days faster.

Earn Points - Redeem for Cash1

Enroll in Brink's Money Payback Points℠. Use your card for signature purchase transactions then redeem those points for cash back on your Card Account.1

Load checks in a snap4

Add check funds to your Brink's Money Prepaid Mastercard with the mobile app.4

Get access to your account wherever you are

Use our mobile apps, Anytime Alerts™ and Online Account Center to access your money and Card Account wherever you are.5

Checks subject to approval. Fees may apply.3

Once your identity is verified and your account is registered, your funds on deposit in your Brink's Money Prepaid Mastercard account are FDIC insured up to $250,000 through Republic Bank & Trust Company, Member FDIC, subject to certain conditions including regulatory requirements for FDIC pass-through insurance and the aggregation of all funds held on deposit in the same capacity at Republic Bank & Trust Company. FDIC insurance protects against the failure of Republic Bank & Trust Company, not the failure of Ouro Global, Inc. (“Ouro”). Ouro, a financial technology company, is not a bank and is not FDIC insured.

1. Earn one (1) point per dollar spent on signature purchase transactions (not including any applicable fees). Certain restrictions apply; see the program terms and conditions for full details, including point earning and redemption parameters. Void where prohibited by law. Republic Bank & Trust Company & Mastercard are not affiliated in any way with this optional offer and do not endorse or sponsor this offer.

2. IMPORTANT INFORMATION FOR OPENING A CARD ACCOUNT: To help the federal government fight the funding of terrorism and money laundering activities, the USA PATRIOT Act requires us to obtain, verify, and record information that identifies each person who opens a Card Account. WHAT THIS MEANS FOR YOU: When you open a Card Account, we will ask for your name, address, date of birth, and your government ID number. We may also ask to see your driver's license or other identifying information. Card activation and identity verification required before you can use the Card Account. If your identity is partially verified, full use of the Card Account will be restricted, but you may be able to use the Card for in-store purchase transactions. Restrictions include: no ATM withdrawals, international transactions, account-to-account transfers and additional loads. Use of Card Account also subject to fraud prevention restrictions at any time, with or without notice. Residents of Vermont are ineligible to open a Card Account.

3. Faster funding claim is based on a comparison of our policy of making funds available upon receipt of payment instruction versus the typical banking practice of posting funds at settlement. Fraud prevention restrictions may delay availability of funds with or without notice. Early availability of funds requires payor's support of direct deposit and is subject to the timing of payor's payment instruction.

4. Mobile Check Load is a service provided by First Century Bank, N.A. and Ingo Money, Inc., subject to the First Century Bank and Ingo Money Terms and Conditions, and Privacy Policy. Approval review usually takes 3 to 5 minutes but can take up to one hour. All checks are subject to approval for funding in Ingo Money's sole discretion. Fees apply for approved Money in Minutes transactions funded to your card. Unapproved checks will not be funded to your card. Ingo Money reserves the right to recover losses resulting from illegal or fraudulent use of the Ingo Money Service. Your wireless carrier may charge a fee for message and data usage. Additional transaction fees, costs, terms and conditions may be associated with the funding and use of your card. See your Cardholder Agreement for details.

5. No charge for this service, but your wireless carrier may charge for messages or data.

6. The $10 Purchase Cushion is not an extension of credit; it is a courtesy exercised at our discretion. Approved purchase transactions may create up to a $10.00 negative balance on your Card Account. Cardholder is responsible for repayment of any negative balance. See the Cardholder Agreement for details.

7. The Pay-As-You-Go Plan is the default Plan Fee on the Card Account. Cardholder may enroll in the Monthly Plan to pay a flat fee of $9.95 per month instead of paying a fee for every purchase transaction under the Pay-As-You-Go Plan. Neither Plan Fee option includes any other fees. If cardholder receives $500 in payroll or government benefit direct deposits in 1 calendar month, cardholder will qualify for the Reduced Monthly Plan. After qualifying, Monthly Plan Cardholders will receive the Reduced Monthly Plan Fee of $5 on their next Plan Fee assessment date. Pay-As-You-Go Cardholders must enroll in the Reduced Monthly Plan to receive it.

8. The Savings Account is made available to Cardholders through Republic Bank & Trust Company; Member FDIC. To participate in the Savings Account program, Cardholder must consent to and continue receiving communications from us in electronic form. If Cardholder is subject to Internal Revenue Service backup withholding at the time of the request to open a Savings Account, the request will be declined. Interest is calculated on the Average Daily Balance(s) of the Savings Account and is paid quarterly.

- If the Average Daily Balance is $1,000.00 or less, the interest rate paid on the entire balance will be 4.91% with an Annual Percentage Yield (APY) of 5.00%.

- If the Average Daily Balance is more than $1,000.00, the interest rate paid on the portion of the Average Daily Balance which exceeds $1,000.00 will be 0.49% with an APY of 0.50%, and the interest paid on the portion of the Average Daily Balance which is $1,000.00 or less will be 4.91%. The APY for this tier will range from 5.00% to 0.54%, depending on the balance in the account.

The interest rates and APYs of each tier may change. The APYs were accurate as of . These are promotional rates and may change without notice pursuant to applicable law. No minimum balance necessary to open Savings Account or obtain the yield(s). Because Savings Account funds are withdrawn through the Card Account (maximum 6 such transfers per calendar month), Card Account transaction fees could reduce the interest earned on the Savings Account.

Apple® and the Apple logo® are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Google Play and the Google Play logo are trademarks of Google LLC.

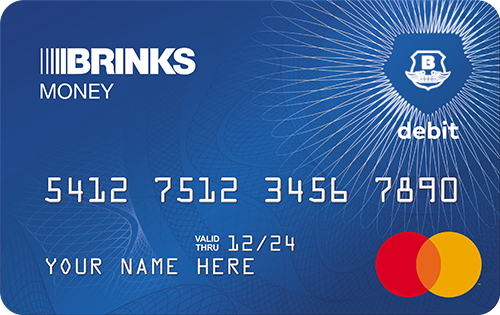

The Brink's Money Prepaid Mastercard is issued by Republic Bank & Trust Company, Member FDIC, pursuant to a license by Mastercard International Incorporated. Ouro Global, Inc. is a registered agent of Republic Bank & Trust Company. Certain products and services may be licensed under U.S. Patent Nos. 6,000,608 and 6,189,787. Use of the Card Account is subject to activation, ID verification, and funds availability. Transaction fees, terms, and conditions apply to the use and reloading of the Card Account. See the Cardholder Agreement for details.

Mastercard and the circles design are registered trademarks of Mastercard International Incorporated.

Card may be used everywhere Debit Mastercard is accepted.

© Ouro Global, Inc. All rights reserved worldwide. Netspend is the federally registered U.S. service mark of Ouro Global, Inc. All other trademarks and service marks belong to their owners.